UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrantþ

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Under §240.14a-12

Kirby Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| KIRBY CORPORATION |

Notice of 20122015

Annual Meeting of Stockholders

and

Proxy Statement

Meeting Date: April 24, 201228, 2015

YOUR VOTE IS IMPORTANT

PLEASE PROMPTLY MARK, DATE, SIGN AND RETURN

YOUR PROXY CARD IN THE ENCLOSED ENVELOPE

KIRBY CORPORATION

55 Waugh Drive, Suite 1000

P. O. Box 1745

Houston, Texas 77251-1745

March 7, 20126, 2015

Dear Fellow Stockholders:

On behalf of the Board of Directors, we cordially invite you to attend the 20122015 Annual Meeting of Stockholders of Kirby Corporation to be held on Tuesday, April 24, 2012,28, 2015, at 10:00 a.m. (CDT). The meeting will be held at 55 Waugh Drive, 9th Floor, Houston, Texas 77007. We look forward to personally greeting those stockholders who will be able to attend the meeting.

This booklet contains the notice of the Annual Meeting and the Proxy Statement, which contains information about the proposals to be voted on at the meeting, Kirby’s Board of Directors and its committees and certain executive officers. This year you are being asked to elect three Class II directors, approve amendments toreapprove the material terms of the performance objectives under Kirby’s 2005 Stock and Incentive Plan, approve an amendment to Kirby’s 2000 Nonemployee Director Stock Plan, ratify the Audit Committee’s selection of KPMG LLP as Kirby’s independent registered public accounting firm for 20122015 and cast an advisory vote on executive compensation.

In addition to the formal proposals to be brought before the Annual Meeting, there will be a report on our Company’s operations, followed by a question and answer period.

Your vote is important. Please ensure that your shares will be represented at the meeting by completing, signing and returning your proxy card in the envelope provided whether or not you plan to attend personally.

Thank you for your continued support and interest in Kirby Corporation.

Sincerely, |

|

|

Chief Executive Officer |

KIRBY CORPORATION

55 Waugh Drive, Suite 1000

P. O. Box 1745

Houston, Texas 77251-1745

NOTICE OF 20122015 ANNUAL MEETING OF STOCKHOLDERS

| Date: | Tuesday, April | |||

| Time: | 10:00 a.m. CDT | |||

| Place: | 55 Waugh Drive | |||

| 9th Floor | ||||

| Houston, Texas 77007 |

Proposals to be voted on at the Kirby Corporation 20122015 Annual Meeting of Stockholders are as follows:

1. Election of three Class II directors;

2. ApprovalReapproval of amendments tothe material terms of the performance objectives under Kirby’s 2005 Stock and Incentive Plan;

3. Approval of an amendment to Kirby’s 2000 Nonemployee Director Stock Plan;

4. Ratification of the Audit Committee’s selection of KPMG LLP as Kirby’s independent registered public accounting firm for 2012;2015;

5.4. Advisory vote on the approval of the compensation of Kirby’s named executive officers; and

6.5. Consideration of any other business that properly comes before the meeting.

You have the right to receive this notice and vote at the Annual Meeting if you were a stockholder of record at the close of business on March 1, 2012.2, 2015. Please remember that your shares cannot be voted unless you sign and return the enclosed proxy card, vote in person at the Annual Meeting, or make other arrangements to vote your shares.

We have enclosed a copy of Kirby Corporation’s 20112014 Annual Report to stockholders with this notice and Proxy Statement.

| For the Board of Directors, |

| THOMAS G. ADLER |

Secretary |

March 7, 20126, 2015

KIRBY CORPORATION

PROXY STATEMENT

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of Kirby Corporation (the “Company”) to be voted at the Annual Meeting of Stockholders to be held at 55 Waugh Drive, 9th Floor, Houston, Texas, on April 24, 2012,28, 2015, at 10:00 a.m. (CDT).

Whenever we refer in this Proxy Statement to the Annual Meeting, we are also referring to any meeting that results from an adjournment or postponement of the Annual Meeting. The Notice of Annual Meeting, this Proxy Statement, the proxy card and the Company’s Annual Report, which includes the Annual Report on Form 10-K for 2011,2014, are being mailed to stockholders on or about March 19, 2012.18, 2015.

SOLICITATION OF PROXIES

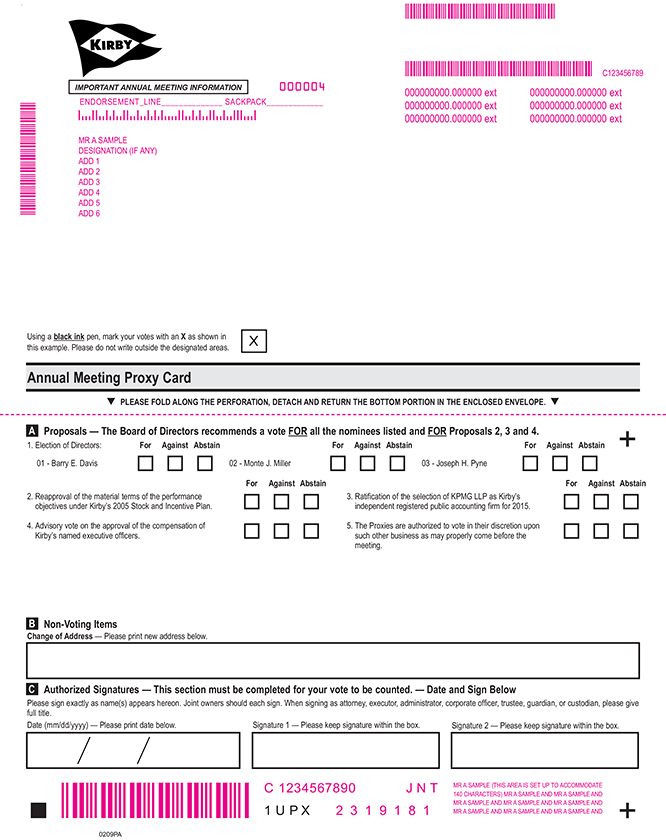

The Proxy Card

Your shares will be voted as specified on the enclosed proxy card. If a proxy is signed without choices specified, those shares will be voted for the election of the Class II directors named in this Proxy Statement, for the approvalreapproval of amendments to Kirby’sthe material terms of the performance objectives under the Company’s 2005 Stock and Incentive Plan, for the approval of an amendment to Kirby’s 2000 Nonemployee Director Stock Plan, for the ratification of the Audit Committee’s selection of KPMG LLP as the Company’s independent registered public accounting firm for 2012,2015, for the approval on an advisory basis of executive compensation and at the discretion of the proxies on other matters.

You are encouraged to complete, sign and return the proxy card even if you expect to attend the meeting. If you sign a proxy card and deliver it to us, but then want to change your vote, you may revoke your proxy at any time prior to the Annual Meeting by sending us a written revocation or a new proxy, or by attending the Annual Meeting and voting your shares in person.

Cost of Soliciting Proxies

The cost of soliciting proxies will be paid by the Company. The Company has retained Georgeson Inc. to solicit proxies at an estimated cost of $6,000, plus out-of-pocket expenses. Employees of the Company may also solicit proxies, for which the expense would be nominal and borne by the Company. Solicitation may be by mail, facsimile, electronic mail, telephone or personal interview.

VOTING

Stockholders Entitled to Vote

Stockholders of record at the close of business on March 1, 20122, 2015 will be entitled to notice of, and to vote at, the Annual Meeting. As of the close of business on March 1, 2012,2, 2015, the Company had 55,847,31755,703,132 outstanding shares of common stock. Each share of common stock is entitled to one vote on each matter to come before the meeting.

Quorum and Votes Necessary to Adopt Proposals

In order to transact business at the Annual Meeting, a quorum consisting of a majority of all outstanding shares entitled to vote must be present. Abstentions and proxies returned by brokerage firms for which no voting instructions have been received from their beneficial owners will be counted for the purpose of determining

21

whether a quorum is present. A majority of the votes cast (not counting abstentions and broker nonvotes) is required for the election of directors (Proposal 1). A majority of the outstanding shares entitled to vote that are represented at the meeting in person or by proxy is required for the approvalreapproval of the proposed amendments tomaterial terms of the performance objectives under the Company’s 2005 Stock and Incentive Plan (Proposal 2) and for the Company’s 2000 Nonemployee Director Stock Plan (Proposals 2 and 3, respectively) and ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for 20122015 (Proposal 4)3). Proposal 54 is a non-binding advisory vote on executive compensation and therefore there is no voting standard for that proposal, since the voting results will be informational only.

Please note that if your shares are held in the name of a brokerage firm on your behalf, your broker may not vote your shares on the election of directors or the matters related to executive compensation without voting instructions from you.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 24, 201228, 2015

This Proxy Statement and the Company’s 20112014 Annual Report, which includes the Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”), are available electronically at www.edocumentview.com/kex.

The following proposals will be considered at the meeting:

Proposal 1 — | Election of three Class II directors | |

Proposal 2 — | ||

Proposal 3 | ||

| Ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for | |

Proposal | Advisory vote on the approval of the compensation of the Company’s named executive officers | |

The Board of Directors of the Company unanimously recommends that you vote “FOR” the Board’s nominees for director, “FOR” approvalthe reapproval of amendments to ourthe material terms of the performance objectives under the Company’s 2005 Stock and Incentive Plan, “FOR” approval of an amendment to our 2000 Nonemployee Director Stock Plan, “FOR” the selection of KPMG LLP as our independent registered public accounting firm for 20122015 and “FOR” approval of our executive compensation.

ELECTION OF DIRECTORS (PROPOSAL 1)

The Bylaws of the Company provide that the Board shall consist of not fewer than three nor more than fifteen members and that, within those limits, the number of directors shall be determined by the Board. The Bylaws further provide that the Board shall be divided into three classes, with the classes being as nearly equal in number as possible and with one class being elected each year for a three-year term. The size of the Board is currently set at ten.nine. Three Class II directors are to be elected at the 20122015 Annual Meeting to serve until the Annual Meeting of Stockholders in 2015.2018.

Each nominee named below isMonte J. Miller and Joseph H. Pyne are both currently serving as a directordirectors and each has consented to serve for the new term if elected. Bob G. Gower, who has served as a director since 1998, will not stand for reelection as a director. The Governance Committee recommended to the Board that Barry E. Davis be nominated to fill the vacancy created by Mr. Gower’s retirement as a director. The Committee retained an executive search firm to assist in the search for qualified candidates. The Committee considered a number of candidates recommended by the search firm in addition to Mr. Davis, who was identified and recommended by the search firm. If any

2

nominee becomes unable to serve as a director, an event currently not anticipated, the persons named as proxies in the enclosed proxy card intend to vote for a nominee selected by the present Board to fill the vacancy.

3

In addition to satisfying, individually and collectively, the Company’s Criteria for the Selection of Directors discussed under the “THE BOARD OF DIRECTORS — Governance Committee” below, each of the directors has extensive experience with the Company or in a business similar to one or more of the Company’s principal businesses or the principal businesses of significant customers of the Company. The brief biographies of each of the nominees and continuing directors below includes a summary of the particular experience and qualifications that led the Board to conclude that he should serve as a director.

Nominees for Election

The Board of Directors of the Company unanimously recommends that you vote “FOR” the election of each of the following nominees as a director.

Nominees for Election as Class II directors to serve until the Annual Meeting of Stockholders in 20152018

| Not Currently a Director | ||

| Age |

Mr. GowerDavis is President, Chief Executive Officer and a private investor. He has served as Chairmandirector of both EnLink Midstream GP, LLC, the general partner of EnLink Midstream Partners, LP, and EnLink Midstream Manager, LLC, the managing member of EnLink Midstream, LLC. EnLink Midstream Partners, LP and EnLink Midstream, LLC (collectively “EnLink Midstream”) are both publicly traded and listed on the New York Stock Exchange (“NYSE”). Prior to the formation of EnLink Midstream in 2014 through the combination of Crosstex Energy and substantially all of the BoardU.S. midstream assets of Ensysce Biosciences, Inc., a company developing cancer therapeutics using nanotechnology,Devon Energy, Mr. Davis had served since 2008. Mr. Gower serves1996 as Chairman of the Audit Committee, is a member of the Executive CommitteePresident and Compensation Committee, and has been chosen by the non-management directors to serve as the presiding director at executive sessions of the non-management directors.

Mr. Gower has 46 years of experience in the chemical business, including 11 years as the Chief Executive Officer of Lyondell Petrochemical Company. TheCrosstex Energy, as a director of Crosstex Energy since 2002 and in management roles with other companies in the energy industry since 1984. Mr. Davis is also a member and former president of the Natural Gas and Electric Power Society and the Dallas Wildcat Committee.

EnLink Midstream provides midstream energy services, including gathering, transmission, processing, fractionation, brine services and marketing of natural gas, natural gas liquids, condensate and crude oil. EnLink Midstream’s assets include an extensive pipeline network, processing plants, fractionation facilities, storage facilities, rail terminals, barge and truck terminals and an extensive fleet of trucks. Understanding the transportation of crude oil, petrochemicals generates a major portionand other commodities was one of the Company’s marine transportation revenues and Mr. Gower’s knowledge of the chemical business is valuableprimary criteria given to the Board.search firm engaged by the Governance Committee to identify director candidates. Mr. Davis has extensive knowledge and experience in the transportation of hydrocarbons, which is the primary business of EnLink Midstream and its predecessors.

| Monte J. Miller | Director since 2006 | |

| Durango, Colorado | Age |

Mr. Miller is a consultant and private investor. He served as Executive Vice President, Chemicals, of Flint Hills Resources, LP (“Flint Hills”), a company engaged in crude oil refining, transportation and marketing, and the production of petrochemicals, from 2003 to 2006. From 1999 to 2003, he was Senior Vice President of Koch Chemical Company, a predecessor company of Flint Hills. Mr. Miller serves as a member of the Compensation Committee and the Governance Committee.

Mr. Miller has 30 years of experience in the petrochemical and refining business. A significant volume of petrochemical products isand refined petroleum products are transported coastwise and on the inland waterways and petrochemicals and refined petroleum products represent a major portion of the Company’s business, so

3

Mr. Miller’s extensive knowledge about petrochemical and refining companies, which constitute a substantial part of the Company’s customer base, as well as the products they ship and the end users of the products, is valuable to the Board. He also has experience in developing and administering incentive compensation programs at companies similar in size to the Company.

| Joseph H. Pyne | Director since 1988 | |

| Houston, Texas | Age |

Mr.Joseph H. Pyne, a director since 1988, is the Chairman of the Board and Chief Executive Officer of the Company. He serves as a member of the Executive Committee.

Mr. Pyne has been with the Company for 3437 years, having served as President of its principal marine transportation subsidiary prior to becomingbefore serving as President and Chief Executive Officer of the Company. In April

4

Company from 1995 to 2010 he was electedand then as Chairman of the Board, President and Chief Executive Officer of the Company and in April 2011 was electedor Chairman of the Board and Chief Executive Officer of the Company. He has primary responsibility for the business and strategic direction of the Company and is an essential link between the Board and the Company’s day-to-day operations.until April 2014. Mr. Pyne has overallextensive knowledge of all aspects of the Company, its history, operations, customers,customer base, financial condition and strategic planning. WithHe has long been active in industry associations that, among other benefits, monitor significant legislative and regulatory developments affecting both the retirement of C. Berdon Lawrence as Chairman of the Board of the Company in April 2010, Mr. Pyne is the only management representative on the Board.marine transportation and diesel engine services businesses.

Directors Continuing in Office

The following persons are directors of the Company who will continue in office.

Continuing Class III directors, serving until the Annual Meeting of Stockholders in 20132016

| C. Sean Day | Director since 1996 | |

| Greenwich, Connecticut | Age |

Mr. Day is Chairman of Teekay Corporation, a diversified foreign flag tank vessel owner and operator.shipping group. He serves as Chairman of the GovernanceCompensation Committee and is a member of the CompensationGovernance Committee. He is also Chairman of Teekay GP L.L.C., the general partner of Teekay LNG Partners L.P., Chairman of Teekay Offshore GP L.L.C., the general partner of Teekay Offshore Partners L.P., Chairman of Teekay Tankers Ltd. and Chairman of Compass Diversified Holdings.

Mr. Day has over 40 years of experience in the marine transportation business, currently serving for the past 17 years as Chairman of one of the largest tanker companies in the world and formerlyfor 10 years before that as chief executive officer of an international bulk shipping company. In addition, Mr. Day has been active in the private equity investment business for the last 2730 years, gaining extensive experience in financial management and analysis.

| William M. Lamont, Jr. | Director since 1979 | |

| Dallas, Texas | Age |

Mr. Lamont is a private investor. He serves as Chairman of the Compensation Committee and is a member of the Executive Committee and GovernanceCompensation Committee.

Mr. Lamont and his family have been major stockholders of the Company since its formation and he has been a director of the Company throughout its transformation from a company engaged in the oil and gas and insurance businesses, among others, into the largest domestic tank barge company in the United States, as well as a significant presence in the diesel engine services business. Through his private investment activities, Mr. Lamont also has extensive experience in financial analysis and in financial markets.

4

| Director since | ||

| Age |

Mr. Lawrence is a consultant for the Company and a private investor. He hasWaterman served as Chairman EmeritusPresident and Chief Executive Officer of the Board of the Company since April 2010 and served as Chairman of the Board of the Company from 1999 until his retirement in April 2010. He was the founder and former President of Hollywood Marine,Penn Maritime Inc. (“Hollywood”Penn”), an inland tank barge company acquired from 1983 through 2012 until the acquisition of Penn by the Company in 1999.December 2012. Penn was a coastal tank barge operator, transporting primarily refinery feedstocks, asphalt and crude oil along the East Coast and Gulf Coast of the United States. He is also a director and past Chairman of The American Waterways Operators, the national trade association for the United States barge industry. Mr. LawrenceWaterman serves as a member of the ExecutiveGovernance Committee.

Mr. LawrenceWaterman has over 4036 years of experience in the inlandcoastal tank barge business with Penn and its predecessor companies, building HollywoodPenn into one of the largest coastal tank barge operators in the United States beforeStates. Mr. Waterman’s extensive experience in that business and knowledge of its merger withmarkets and customers are valuable to the Company. Since the merger, he and Mr. Pyne

5

have successfully integrated the two companies into an efficient and safety-conscious operation with the size and flexibility to serve the needs of the largest customers. In addition to Mr. Lawrence’s extensive knowledgeBoard in its oversight of the Company’s operationscoastal business and customer base, he has long been active in industry associations that monitor significant legislative and regulatory developments along with other issues critical tocomplement the inland marine transportation industry.and petrochemical industry experience of other Company directors.

Continuing Class I directors, serving until the Annual Meeting of Stockholders in 20142017

| Richard J. Alario | Director since 2011 | |

| Houston, Texas | Age |

Mr. Alario is Chairman of the Board, President and Chief Executive Officer of Key Energy Services, Inc. (“Key Energy”), a publicly traded oilfield service company listed on the New York Stock Exchange (“NYSE”).NYSE. He has served in senior executive positions with Key Energy since 2004. Prior to joining Key Energy, Mr. Alario served as Vice President of BJ Services Company, an oilfield service company, from 2002 to 2004, and served for over 21 years in various capacities, most recently Executive Vice President, of OSCA, Inc., also an oilfield service company. He serves as Chairman of the Governance Committee and is a member of the Audit Committee. He currently serves as a Director and Executive Committee member and Chairman of the Health, Safety, Security and Environment Committee of the National Ocean Industries Association and serves asis a member of the American Association of Drilling Engineers and the Petroleum Equipment Suppliers Association. HeMr. Alario is a director of Distribution Now and serves as a memberChairman of the Audit Committee. Mr. Alarioits compensation committee. He also served as a director of Seahawk Drilling, Inc. from 2009 to 2011.

Mr. Alario has over 30 years of experience in the oilfield service business, currently serving as Chief Executive Officer with both operating and financial responsibility for one of the largest oilfield service companies in the United States. That experience is valuable to the Board in its oversight of the Company’s diesel engine services business which serves the oilfield services industry as a significant part of its customer base. Mr. Alario also addsAs a current public company Chief Executive Officer, Mr. Alario adds that perspective to the Board.

Mr. Lemmon is a private investor. He served as President and Chief Executive Officer of Colonial Pipeline Company, an interstate common carrier of refined liquid petroleum products, from 1997 to 2006. Prior to that, he held management positions with Amoco Corporation and Amoco Pipeline. He serves as a membercollective experience of the Audit Committee. Mr. Lemmon is also a director of Teekay Offshore GP L.L.C., the general partner of Teekay Offshore Partners L.P., and Deltic Timber Corporation.

Colonial Pipeline Company is the world’s largest refined liquid petroleum products pipeline and a competing mode of transportation for the Company’s tank barge business. Under Mr. Lemmon’s leadership, Colonial placed a strong emphasis on safety and environmental compliance in its operations, receiving the American Petroleum Institute’s “Most Distinguished Pipeline Award for Safety and Environmental Leadership” for four years in a row from 2002 through 2005. Mr. Lemmon’s accomplishments reinforce the Company’s emphasis on safety and its achievement of one of the best safety records in the tank barge industry.

Mr. Peterkin is a private investor. He has served as Chairman Emeritus of the Board of the Company since 1999 and served as Chairman of the Board of the Company from 1995 to 1999. He served as President of the Company from 1973 to 1995 and serves as a member of the Executive Committee.

Mr. Peterkin has served in executive positions in the marine transportation business with the Company and its predecessor companies for over 50 years. During his tenure as President and then Chairman of the Board of the

6

Company, he presided over the Company’s transition from an oil and gas and insurance company with a small barge line to the largest inland tank barge company in the United States. Mr. Peterkin’s knowledge of and perspective on the Company and its history, growth and principal businesses are a valuable resource for the Board.independent directors.

| Richard R. Stewart | Director since 2008 | |

| Houston, Texas | Age |

Mr. Stewart served as President and Chief Executive Officer of GE Aero Energy, a division of GE Energy, and as an officer of General Electric Company, from 1998 until his retirement in December 2006. From 1972 to 1998, Mr. Stewart served in various positions at Stewart & Stevenson Services, Inc. (“Stewart & Stevenson”), including Group President and member of the Board of Directors. He serves as a memberChairman of the Audit Committee. Mr. Stewart is also a director of Eagle Materials Inc. and a former director of Lufkin Industries, Inc.

During a 35-year business career, Mr. Stewart has been the principal executive officer with both operating and financial responsibility for the diesel engine power and service businesses at Stewart & Stevenson and then at GE Aero Energy. Mr. Stewart’s extensive experience in the diesel engine business is valuable to the Board in its oversight of the Company’s diesel engine services business and complements the marine transportation and petrochemical industry experience of a number of the Company’s other directors.

5

| David W. Grzebinski | Director since 2014 | |

| Houston, Texas | Age 53 |

Mr. Grzebinski has served as President and Chief Executive Officer of the Company since April 2014. He served as President and Chief Operating Officer of the Company from January 2014 to April 2014 and as Executive Vice President and Chief Financial Officer from March 2010 to April 2014. He served as Chairman of the Company’s principal offshore marine transportation subsidiary from February 2012 to April 2013. Prior to joining the Company in February 2010, he served in various administrative and operating positions with FMC Technologies Inc. (“FMC”), a global provider of advanced technology systems and products for the energy industry, including Controller, Energy Services, Treasurer and Director of Global SAP and Industry Relations. Prior to joining FMC, he was employed by Dow Chemical Company.

Mr. Grzebinski has primary responsibility for the business and strategic direction of the Company and is an essential link between the Board and the Company’s day-to-day operations. He has overall knowledge of all aspects of the Company, its operations, customers, financial condition and strategic planning.

Except as noted, each of the nominees for director and each of the continuing directors has been engaged in his principal occupation for more than the past five years.

THE BOARD OF DIRECTORS

The Company’s business is managed under the direction of the Board, which is responsible for broad corporate policy and for monitoring the effectiveness of Company management. Members of the Board are kept informed about the Company’s businesses by participating in meetings of the Board and its committees, through operating and financial reports made at Board and committee meetings by Company management, through various reports and documents sent to the directors for their review and by visiting Company facilities.

Director Independence

The NYSE listing standards require listed companies to have at least a majority of independent directors. For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with the Company.

The Board has determined that C. Sean Day, Bob G. Gower, William M. Lamont, Jr., David L. Lemmon, Monte J. Miller, George A. Peterkin, Jr.the following incumbent directors and Richard R. Stewartdirector nominee have no relationship with the Company except as directors or nominee for director and stockholders and are independent within the meaning of the NYSE corporate governance rules. rules:

Barry E. Davis | William M. Lamont, Jr. | |

C. Sean Day | Monte J. Miller | |

Bob G. Gower | Richard R. Stewart |

The Board has also determined that an indirect relationship between Mr.Richard J. Alario and the Company through Key Energy is not material and that Mr. Alario is also independent. Key Energy is a customer of United Holdings LLC (“United Holdings”), a wholly owned subsidiary of the Company that provided diesel engine equipment, parts and service to Key Energy in the ordinary course of business in 2011.2014. The Company acquired United Holdings on April 15, 2011 and the volume of business done between Key Energy and United Holdings during 2011 after United Holdings2014 was acquired by the Company was $7,978,000,$1,232,000, which represents less than 1/2% 1% of Key Energy’s total revenues for 2011.2014. The business relationship between Key Energy and United Holdings predates both the Company’s acquisition of United Holdings in April 2011 and the election of Mr. Alario to the Board.

In addition,December 2012, the Board has previously determinedCompany acquired Penn and an affiliated company from William M. Waterman and members of his family for approximately $175,000,000 in cash and Company stock. Mr. Waterman and his family sold their entire interest in Penn and affiliated companies to the Company and he resigned from all director and officer positions he held with Penn and affiliated companies contemporaneously with the closing of

6

the acquisition by the Company. In connection with the acquisition, Mr. Waterman entered into a three-year noncompetition agreement with the Company that James R. Clark, who served as a directoris not in any way contingent on continued service with the Company or any of its subsidiaries. A portion of the purchase price for the acquisition consisting of approximately $24,000,000 in cash and 83,825 shares of Company stock was held in escrow to secure the sellers’ indemnification of the Company untilfor breaches of representations and warranties in the 2011 Annual Meetingpurchase agreement. The escrow account terminated on March 31, 2014 and the cash and stock, net of Stockholders, had no relationship witha $17,000 claim, were distributed to Mr. Waterman, members of his family and a family trust. The Board determined that the Company except as a directorexistence of the escrow account did not affect Mr. Waterman’s independence and stockholder and wasdetermined that he is independent.

7

Board Committees

The Board has established fourthree standing committees, including the Audit Committee, the Compensation Committee and the Governance Committee, each of which is briefly described below. The fourth committee, the Executive Committee, may exercise all of the power and authority of the Board in the management of the business and affairs of the Company when the Board is not in session, except the power or authority to fill vacancies in the membership of the Board, to amend the Bylaws of the Company and to fill vacancies in the membership of the Executive Committee.

Audit Committee

All of the members of the Audit Committee are independent, as that term is defined in applicable SEC and NYSE rules. In addition, the Board has determined that all of the members of the Audit Committee are “audit committee financial experts,” as that term is defined in SEC rules. The Audit Committee operates under a written charter adopted by the Board. A copy of the charter is available on the Company’s web site at www.kirbycorp.com in the Investor Relations section under Corporate Governance.

| Principal Functions | Members | |

• Monitor the Company’s financial reporting, accounting procedures and systems of internal control |

Richard J. Alario

| |

• Select the independent auditors for the Company | ||

• Review the Company’s audited annual and unaudited quarterly financial statements with management and the independent auditors | ||

• Monitor the independence and performance of the Company’s independent auditors and internal audit function | ||

• Monitor the Company’s compliance with legal and regulatory requirements |

Compensation Committee

All of the members of the Compensation Committee are independent, as that term is defined in applicable SEC and NYSE rules. In addition, all of the members of the Compensation Committee are “Non-Employee Directors” and “outside directors” as defined in relevant federal securities and tax regulations. The Compensation Committee operates under a written charter adopted by the Board. A copy of the charter is available on the Company’s web site at www.kirbycorp.com in the Investor Relations section under Corporate Governance.

| Principal Functions | Members | |

• Determine the compensation of executive officers of the Company | C. Sean Day (Chairman) Bob G. Gower William M. Lamont, Jr.

Monte J. Miller | |

• Administer the Company’s annual incentive bonus program | ||

• Administer the Company’s stock option, restricted stock and incentive plans and grant stock options, restricted stock and performance awards under such plans |

87

Governance Committee

All of the members of the Governance Committee are independent, as that term is defined in NYSE rules. The Governance Committee operates under a written charter adopted by the Board. A copy of the charter is available on the Company’s web site at www.kirbycorp.com in the Investor Relations section under Corporate Governance.

| Principal Functions | Members | |

• Perform the function of a nominating committee in recommending candidates for election to the Board | Richard J. Alario (Chairman) C. Sean Day

Monte J. Miller William M. Waterman | |

• Review all related | ||

• Oversee the operation and effectiveness of the Board | ||

The Governance Committee will consider director candidates recommended by stockholders.stockholders or proposed by stockholders in accordance with the Company’s Bylaws. Recommendations may be sent to the Chairman of the Governance Committee, Kirby Corporation, 55 Waugh Drive, Suite 1000, Houston, Texas 77007, accompanied by biographical information for evaluation. The Board of the Company has approved Criteria for the Selection of Directors which the Governance Committee will consider in evaluating director candidates. The criteria address compliance with SEC and NYSE requirements relating to the composition of the Board and its committees, as well as character, integrity, experience, understanding of the Company’s business and willingness to commit sufficient time to the Company’s business. The criteria are available on the Company’s web site at www.kirbycorp.com in the Investor Relations section under Corporate Governance.

In addition to the criteria, the Governance Committee and the Board will consider diversity in business experience, professional expertise, gender and ethnic background in evaluating potential nominees for director. The Company’s Corporate Governance Guidelines and Governance Committee Charter include provisions concerning the consideration of diversity in business experience, professional skills, gender and ethnic background in selecting nominees for director.

When there is a vacancy on the Board (i.e., in cases other than the nomination of an existing director for reelection), the Board and the Governance Committee have considered candidates identified by executive search firms, candidates recommended by stockholders and candidates recommended by other directors. The Governance Committee will continue to consider candidates from any of those sources when future vacancies occur. The Governance Committee does not evaluate a candidate differently based on whether or not the candidate is recommended by a stockholder.

Attendance at Meetings

It is the Company’s policy that directors are expected to attend Board meetings and meetings of committees on which they serve and are expected to attend the Annual Meeting of Stockholders of the Company. During 2011,2014, the Board met seven times, the Audit Committee met eight times, the Compensation Committee met sevensix times and the Governance Committee met sixfour times. Each director attended all of the meetings of the Board and of the committees on which he served. All directors attended the 20112014 Annual Meeting of Stockholders of the Company.

Director Compensation

Directors who are employees of the Company receive no additional compensation for their servicesservice on the Board or Board committees.Board. Compensation of nonemployee directors is determined by the full Board, which may consider recommendations of the Compensation Committee. Past practice has been to review director compensation when the Board believes that an adjustment may be necessary in order to remain competitive with director compensation of comparable companies. Management of the Company periodically collects published survey information on director compensation for purposes of comparison.

98

Each nonemployee director receives an annual fee of $24,000, a fee of $1,250 for each Board meeting attended and a fee of $3,000 for each committee meeting attended. A director may elect to receive the annual fee in cash, stock options or restricted stock. The Compensation and Governance Committee Chairmen receive an additional $10,000 retainer per year, the Audit Committee Chairman receives an additional $15,000 retainer per year and the presiding director at executive sessions of the non-management directors receives an additional $5,000 retainer per year. Directors are reimbursed for reasonable expenses incurred in attending meetings.

In addition to the fees provided to the directors described above, the Company has a nonemployee director stock plan under which nonemployee directors are granted stock options and restricted stock awards. The Company’s 2000 Nonemployee Director Stock Plan (the “2000 Plan”) provides for the automatic grant to nonemployee directors of stock options for 10,000 shares of common stock on the date of first election as a director and stock options for 6,000 shares and 1,000 shares of restricted stock immediately after each annual meeting of stockholders. The 2000 Plan also provides for discretionary grants of an aggregate of 10,000 shares in the form of stock options or restricted stock. In addition, the 2000 Plan provides for the issuance of stock options or restricted stock in lieu of cash for all or part of the annual director fee. A director who elects to receive options in lieu of the annual cash fee will be granted an option for a number of shares equal to (a) the amount of the fee for which the election is made divided by (b) the fair market value per share of the common stock on the date of grant multiplied by (c) 3. A director who elects to receive restricted stock in lieu of the annual cash fee will be issued a number of shares of restricted stock equal to (a) the amount of the fee for which the election is made divided by (b) the fair market value per share of the common stock on the date of grant multiplied by (c) 1.2. The exercise price for all options granted under the 2000 Plan is the fair market value per share of the Company’s common stock on the date of grant. The options granted on first election as a director vest immediately. The options granted and restricted stock issued immediately after each annual meeting of stockholders vest six months after the date of grant or issuance. Options granted and restricted stock issued in lieu of cash director fees vest in equal quarterly increments during the year to which they relate. The options generally remain exercisable for ten years after the date of grant.

In 2008, theThe Board has established stock ownership guidelines for officers and directors of the Company. The guidelines were effective January 1, 2009 and nonemployeeNonemployee directors must be in compliance within five years after the adoption of the guidelines or five years after first election as a director, whichever is later, but are expected to accumulate the required number of shares ratably over the applicable five-year period. Under the guidelines, nonemployee directors are required to own common stock of the Company having a value equal to four times the annual cash director fee. As of March 2, 2015, all directors were in compliance with the stock ownership guidelines. The Governance Committee of the Board will monitor compliance with the guidelines and may recommend modifications or exceptions to the Board.

The following table summarizes the cash and equity compensation for nonemployee directors for the year ended December 31, 2011:2014:

Director Compensation for 20112014

Name | Fees Earned or Paid in Cash | Stock Awards(1)(2) | Option Awards(1)(2) | Total | Fees Earned or Paid in Cash | Stock Awards(1)(2) | Option Awards(1)(2) | Total | ||||||||||||||||||||||||

Richard J. Alario | $ | 2,500 | $ | 18,704 | $ | 221,500 | $ | 242,704 | $ | 46,250 | $ | 128,382 | $ | 234,780 | $ | 409,412 | ||||||||||||||||

James R. Clark(3) | 14,000 | 7,221 | — | 21,221 | ||||||||||||||||||||||||||||

C. Sean Day | 57,750 | 85,773 | 135,900 | 279,423 | 48,750 | 128,382 | 234,780 | 411,912 | ||||||||||||||||||||||||

Bob G. Gower | 73,750 | 56,790 | 164,967 | 295,507 | 59,500 | 128,382 | 234,780 | 422,662 | ||||||||||||||||||||||||

William M. Lamont, Jr. | 81,750 | 56,790 | 135,900 | 274,440 | 59,250 | 99,522 | 234,780 | 393,552 | ||||||||||||||||||||||||

C. Berdon Lawrence | 32,750 | 56,790 | 135,900 | 225,440 | ||||||||||||||||||||||||||||

David L. Lemmon | 56,750 | 56,790 | 135,900 | 249,440 | ||||||||||||||||||||||||||||

David L. Lemmon(3) | 18,750 | — | — | 18,750 | ||||||||||||||||||||||||||||

Monte J. Miller | 38,750 | 64,011 | 157,576 | 260,337 | 38,750 | 128,382 | 234,780 | 401,912 | ||||||||||||||||||||||||

George A. Peterkin, Jr. | 32,750 | 56,790 | 143,291 | 232,831 | ||||||||||||||||||||||||||||

Richard R. Stewart(4) | 56,750 | 170,000 | 135,900 | 362,650 | ||||||||||||||||||||||||||||

George A. Peterkin, Jr(3). | 3,750 | — | — | 3,750 | ||||||||||||||||||||||||||||

Richard R. Stewart | 68,000 | 99,522 | 234,780 | 402,302 | ||||||||||||||||||||||||||||

William M. Waterman | 38,750 | 99,522 | 234,780 | 373,052 | ||||||||||||||||||||||||||||

| (1) | The amounts included in the “Stock Awards” and “Option Awards” columns represent the grant date fair value related to restricted stock awards and option grants to the directors, computed in accordance with |

109

| FASB ASC Topic 718. For a discussion of valuation assumptions, see Note |

| (2) | Each director was granted 1,000 shares of restricted stock on April |

The following table shows the aggregate number of shares of unvested restricted stock and stock options outstanding for each director as of December 31, 2014, as well as the grant date fair value of restricted stock and stock option grants made during 2014:

Name | Aggregate Shares of Restricted Stock Outstanding as of December 31, 2011 | Aggregate Stock Options Outstanding as of December 31, 2011 | Grant Date Fair Value of Restricted Stock and Stock Options Awarded during 2011 | |||||||||

Richard J. Alario | 120 | 10,000 | $ | 248,220 | ||||||||

C. Sean Day | 128 | 48,000 | 221,706 | |||||||||

Bob G. Gower | — | 42,753 | 221,592 | |||||||||

William M. Lamont, Jr. | — | 60,000 | 192,690 | |||||||||

C. Berdon Lawrence | — | 12,000 | 192,690 | |||||||||

David L. Lemmon | — | 36,000 | 192,690 | |||||||||

Monte J. Miller | — | 49,264 | 221,592 | |||||||||

George A. Peterkin, Jr. | — | 67,608 | 192,690 | |||||||||

Richard R. Stewart | 1,500 | 28,000 | 364,260 | |||||||||

Name | Aggregate Shares of Unvested Restricted Stock as of December 31, 2014 | Aggregate Stock Options Outstanding as of December 31, 2014 | Grant Date Fair Value of Restricted Stock and Stock Options Awarded during 2014 | |||||||||

Richard J. Alario | 73 | 29,153 | $ | 363,162 | ||||||||

C. Sean Day | 73 | 36,000 | 363,162 | |||||||||

Bob G. Gower | 73 | 6,000 | 363,162 | |||||||||

William M. Lamont, Jr. | — | 60,000 | 334,302 | |||||||||

David L. Lemmon(3) | — | 12,000 | — | |||||||||

Monte J. Miller | 73 | 49,276 | 363,162 | |||||||||

George A. Peterkin, Jr.(3) | — | 59,905 | — | |||||||||

Richard R. Stewart | — | 24,000 | 334,302 | |||||||||

William M. Waterman | — | 22,000 | 334,302 | |||||||||

| (3) | Mr. |

Board Leadership Structure

The Board has no set policy concerning the separation of the offices of Chairman of the Board and Chief Executive Officer, but retains the flexibility to decide how the two positions should be filled based on the circumstances existing at any given time. The roles of Chairman of the Board and Chief Executive Officer of the Company were separated for many years, with Mr. Lawrence serving as Chairman of the Board and Mr. Pyne serving as President and Chief Executive Officer from 1999 until Mr. Lawrence’s retirement as Chairman in April 2010. The Board has placed considerable emphasis on management succession planning and decided that, upon Mr. Lawrence’s retirement, the election of Mr. Pyne as Chairman of the Board in addition to Chief Executive Officer would best serve the Company’s needs and the succession process. In light of the economic conditions during recent years and the significant acquisitions completed by the Company during 2011 and 2012 and the challenge of integrating these acquisitions with the Company’s operations, the Board considersconsidered it important for Mr. Pyne, with his comprehensive understanding of the Company’s businesses and strategic direction, to continue to have someone inassume the role of Chairman of the Board, with a comprehensive understanding of,in addition to serving as well as primary responsibilityChief Executive Officer. During the same time period, the Board was focused on management succession planning, primarily for the Company’s businessesrole of Chief Executive Officer but also for other senior management positions. The Board determined that having Mr. Pyne continue to serve as an executive Chairman of the Board after relinquishing the role of Chief Executive Officer would facilitate the succession process and strategic direction.provide valuable support to the new senior management team.

11

The Board does not have a “lead director,” but has chosen Mr. Gower to be the “presiding director” to preside at the regular executive sessions of the non-management directors that are held at least quarterly. Mr. Gower also serves as a liaison between the independent directors and management on certain matters that are not within the area of responsibility of a particular committee of the Board.

Risk Oversight

The Board carries out its risk oversight function primarily through the Audit Committee.Committee and the full Board. Management prepares and reviews with the Audit Committee annuallyand the Board semiannually a comprehensive assessment of the identified internal and external risks of the Company that includes evaluations of the potential

10

impact of each identified risk, its probability of occurrence and the effectiveness of the controls that are in place to mitigate the risk. The Audit Committee then brings to the attention of the Board any issues that warrant further discussion or action. The Audit Committee and the Board also receive regular reports of any events or circumstances involving risks outside the normal course of business of the Company. At times, a particular risk will be monitored and evaluated by another Board committee with primary responsibility in the area involved, such as the Compensation Committee’s review of the risks related to the Company’s compensation policies and practices. The Board’s administration of its risk oversight function has not affected the Board’s leadership structure.

TRANSACTIONS WITH RELATED PERSONS

The Board has adopted a written policy on transactions with related persons that provides that certain transactions involving the Company and any of its directors, executive officers or major stockholders or members of their immediate families, including all transactions that would be required to be disclosed as transactions with related persons in the Company’s Proxy Statement, are subject to approval in advance by the Governance Committee, except that a member of the Committee will not participate in the review of a transaction in which that member has an interest. The Committee has the discretion to approve any transaction which it determines is in, or not inconsistent with, the best interests of the Company and its stockholders. If for any reason a transaction with a related person has not previously been approved, the Committee will review the transaction within a reasonable period of time and either ratify the transaction or recommend other actions, including modification, rescission or termination, taking into consideration the Company’s contractual obligations. If a transaction is ongoing or consists of a series of similar transactions, the Committee will review the transaction at least annually and either ratify the continuation of the transaction or recommend other actions, including modification, rescission or termination, taking into consideration the Company’s contractual obligations. The policy provides certain exceptions, including compensation approved by the Board or its Compensation Committee.

During 2011,Mr. Alario, a director of the Company, is the Chairman of the Board, President and its subsidiariesChief Executive Officer of Key Energy. Key Energy paid 55 Waugh, LP, a partnership owned 60% by Mr. Lawrencethe Company $1,232,000 in 2014 for oilfield service equipment and his family, $1,491,000 for the rental of office space in a building owned by 55 Waugh, LP. The Company’s headquarters are locatedparts and service in the building under a lease that was signed in 2005, prior to the purchaseordinary course of business of the building by 55 Waugh, LP, and expires at the end of 2015. The aggregate amount of rent due from January 1, 2011 to the end of the lease term on December 31, 2015 is approximately $6,294,000.Company.

The Company is a 50% owner of The Hollywood Camp, L.L.C. (“The Hollywood Camp”), a company that owns and operates a hunting and fishing facility used by the Company and L3 Partners, LLC (“L3P”), a company owned by Mr. Lawrence, which is also a 50% owner. The Company uses The Hollywood Camp primarily for customer entertainment. L3P acts as manager of The Hollywood Camp. The Hollywood Camp allocates lease and lodging expenses to its members based on their usage of the facilities. During 2011, the CompanyKey Energy paid $2,121,000 to The Hollywood Camp $1,634,000 for its shareuse of the facility expenses.during 2014.

Mr. Alario, a currentWaterman is the former President and owner (together with family members) of Penn but resigned as an officer and director of Penn and affiliated companies contemporaneously with the closing of the 2012 acquisition of Penn by the Company and no longer has any ownership interest in or position with Penn or any of its affiliated companies. A portion of the purchase price for the acquisition consisting of approximately $24,000,000 in cash and 83,825 shares of Company stock was held in escrow to secure the sellers’ indemnification of the Company is the Chairmanfor breaches of the Board, Presidentrepresentations and Chief Executive Officer of Key Energy. In 2011, Key Energy paid the Company $7,978,000 for oilfield service equipment and for parts and service. Such sales and service werewarranties in the ordinary coursepurchase agreement. The escrow account terminated on March 31, 2014 and the cash and stock, net of businessa $17,000 claim, were distributed to Mr. Waterman, members of the Company.his family and a family trust.

12

The husband of Amy D. Husted, Vice President — Legal of the Company, is a partner in the law firm of Strasburger & Price, LLP. In 2011, theThe Company paid the law firm $483,000$1,184,000 in 2014 for legal services in connection with matters in the ordinary course of businessservices. Mr. Pyne or Mr. Grzebinski approves each engagement of the Company.

The brother-in-law of Ronald A. Dragg, Vice President and Controller offirm by the Company is a 50% ownerand the payment of MB Western Industrial Contracting Company (“MB Western”). In 2011,fees billed by the Company paid MB Western $1,160,000 for shoreside facilities construction services. Such services were completed in the ordinary course of business of the Company.firm.

Wayne G. Strahan, the brother of Dorman L.D. Lynn Strahan, the President of one of the Company’s two principal diesel engine services subsidiaries, is the Service Manager of the Company’s diesel engine services facility in Tampa, Florida. In 2011,2014, Wayne G. Strahan received compensation of $134,735$148,000 from the Company.

11

CORPORATE GOVERNANCE

Business Ethics Guidelines

The Board has adopted Business Ethics Guidelines that apply to all directors, officers and employees of the Company. A copy of the Business Ethics Guidelines is available on the Company’s web site at www.kirbycorp.com in the Investor Relations section under Corporate Governance. The Company is required to make prompt disclosure of any amendment to or waiver of any provision of its Business Ethics Guidelines that applies to any director or executive officer or to its chief executive officer, chief financial officer, chief accounting officer or controller, or persons performing similar functions. The Company will make any such disclosure that may be necessary by posting the disclosure on its web site at www.kirbycorp.com in the Investor Relations section under Corporate Governance.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines. A copy of the guidelines is available on the Company’s web site at www.kirbycorp.com in the Investor Relations section under Corporate Governance.

Communication with Directors

Interested parties may communicate with the full Board or any individual directors, including the Chairmen of the Audit, Compensation and Governance Committees, the presiding director or the non-management or independent directors as a group, by writing to them c/o Kirby Corporation, 55 Waugh Drive, Suite 1000, Houston, Texas 77007. Complaints about accounting, internal accounting controls or auditing matters should be directed to the Chairman of the Audit Committee at the same address. All communications will be forwarded to the person(s) to whom they are addressed.

Web Site Disclosures

The following documents and information are available on the Company’s web site at www.kirbycorp.com in the Investor Relations section under Corporate Governance:

Audit Committee Charter

Compensation Committee Charter

Governance Committee Charter

Criteria for the Selection of Directors

Business Ethics Guidelines

13

Corporate Governance Guidelines

Communication with Directors

12

BENEFICIAL OWNERSHIP OF COMMON STOCK

Beneficial Ownership of Directors and Executive Officers

The following table shows the number of shares of common stock beneficially owned by each director, each named executive officer listed in the Summary Compensation Table, and by the directors and executive officers of the Company as a group as of March 1, 2012.2, 2015. Under rules of the SEC, “beneficial ownership” is deemed to include shares for which the individual, directly or indirectly, has or shares voting or investment power, whether or not they are held for the individual’s benefit. Except as otherwise indicated, the persons named have sole voting and investment power over the shares shown.

| Shares of Common Stock Beneficially Owned on March 1, 2012 | Percent of Common Stock(3) | Shares of Common Stock Beneficially Owned on March 2, 2015 | Percent of Common Stock(3) | |||||||||||||||||||||||||||||||||||||

| Direct(1) | Indirect | Right to Acquire(2) | Total | Direct(1) | Indirect | Right to Acquire(2) | Total | |||||||||||||||||||||||||||||||||

DIRECTORS | ||||||||||||||||||||||||||||||||||||||||

Richard J. Alario | 479 | — | 10,000 | 10,479 | 4,153 | — | 29,153 | 33,306 | ||||||||||||||||||||||||||||||||

C. Sean Day | 22,634 | — | 48,000 | 70,634 | 41,769 | — | 36,000 | 77,769 | ||||||||||||||||||||||||||||||||

Bob G. Gower | 43,922 | — | 14,574 | 58,496 | 33,509 | — | 6,000 | 39,509 | ||||||||||||||||||||||||||||||||

David W. Grzebinski | 47,987 | — | 33,189 | 81,176 | ||||||||||||||||||||||||||||||||||||

William M. Lamont, Jr. | 47,284 | (4) | — | 60,000 | 107,284 | 62,284 | (4) | — | 60,000 | 122,284 | ||||||||||||||||||||||||||||||

C. Berdon Lawrence | 181,171 | 34,227 | (5) | 212,000 | (6) | 427,398 | ||||||||||||||||||||||||||||||||||

David L. Lemmon | 6,000 | — | 36,000 | 42,000 | ||||||||||||||||||||||||||||||||||||

Monte J. Miller | 8,973 | — | 49,264 | 58,237 | 5,310 | — | 49,276 | 54,586 | ||||||||||||||||||||||||||||||||

George A. Peterkin, Jr. | 199,984 | (7) | 66,560 | (8) | 67,608 | 334,152 | ||||||||||||||||||||||||||||||||||

Joseph H. Pyne | 431,247 | — | 149,680 | 580,927 | 1.0 | % | 226,987 | — | 85,351 | 312,338 | ||||||||||||||||||||||||||||||

Richard R. Stewart | 7,000 | — | 28,000 | 35,000 | 10,000 | — | 24,000 | 34,000 | ||||||||||||||||||||||||||||||||

William M. Waterman | 102,001 | 202,249 | (5) | 22,000 | 326,250 | |||||||||||||||||||||||||||||||||||

NAMED EXECUTIVES | ||||||||||||||||||||||||||||||||||||||||

Gregory R. Binion | 53,836 | — | 56,471 | 110,307 | ||||||||||||||||||||||||||||||||||||

David W. Grzebinski | 43,480 | — | 7,982 | 51,462 | ||||||||||||||||||||||||||||||||||||

William G. Ivey | 35,603 | — | 31,416 | 67,019 | 26,264 | — | 12,921 | 39,185 | ||||||||||||||||||||||||||||||||

Dorman L. Strahan | 42,946 | — | 15,341 | 58,287 | ||||||||||||||||||||||||||||||||||||

Directors and Executive Officers as a group | 1,259,657 | 100,787 | 860,016 | 2,220,460 | 3.9 | % | ||||||||||||||||||||||||||||||||||

C. Andrew Smith | 10,946 | — | 1,185 | 12,131 | ||||||||||||||||||||||||||||||||||||

James F. Farley | 29,355 | — | 11,304 | 40,659 | ||||||||||||||||||||||||||||||||||||

Directors and Executive Officers as a group | 711,991 | 203,988 | 418,752 | 1,334,731 | 2.4 | % | ||||||||||||||||||||||||||||||||||

| (1) | Shares owned as of March |

| (2) | Shares with respect to which a director or executive officer has the right to acquire beneficial ownership within 60 days after March |

| (3) | No percent of class is shown for holdings of less than 1%. |

| (4) | Does not include |

| (5) |

1413

Principal Stockholders

The following table and notes set forth information as of the dates indicated concerning persons known to the Company to be the beneficial owner of more than 5% of the Company’s outstanding common stock, based on filings with the SEC:

Name and Address | Number of Shares Beneficially Owned | Percent of Class(1) | ||||||

Select Equity Group, Inc. and 380 Lafayette Street, 6th Floor New York, NY 10003 |

| 3,053,728 | (2) |

| 5.47 | % | ||

Araltec, S.L. Calle Santisima Trinidad, 2 Madrid, Spain 28010 | 2,990,190 | (3) | 5.35 | % | ||||

Name and Address | Number of Shares Beneficially Owned | Percent of Class(1) | ||||||

BlackRock, Inc. 55 East 52nd Street New York, NY 10022 | 4,778,299 | (2) | 8.6 | % | ||||

Select Equity Group, L.P. and George S. Loening 380 Lafayette Street, 6th Floor New York, NY 10003 | 4,524,759 | (3) | 8.1 | % | ||||

The Vanguard Group. 100 Vanguard Blvd Malvern, PA 19355 | 3,301,202 | (4) | 5.9 | % | ||||

| (1) | Based on the Company’s outstanding shares of common stock on March |

| (2) | Based on Schedule 13G, dated |

| (3) | Based on Schedule 13G, dated |

| (4) | Based on Schedule 13G, dated February 10, 2015, filed by The Vanguard Group with the SEC. |

Section 16(a) Beneficial Ownership Reporting Compliance

The Company’s directors and executive officers, and persons who own beneficially more than 10% of the Company’s common stock, are required under Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) to file reports of beneficial ownership and changes in beneficial ownership of the Company’s common stock with the SEC and the NYSE. Based solely on a review of the copies of reports furnished to the Company and written representations that no other reports were required, the Company believes that its executive officers and directors complied with all Section 16(a) filing requirements during 2011, except that a report covering three sales on July 24, 2010, July 26, 2010 and November 24, 2010 of an aggregate of 12,130 shares by a trust for the benefit of Mr. Lamont’s wife was filed on March 29, 2011, a report covering two sales on October 17 and October 31, 2011 of an aggregate of 1,700 shares by a trust for the benefit of Mr. Lamont’s wife was filed on November 16, 2011 and a report covering two sales on November 21 and November 30, 2011 of an aggregate of 2,850 shares by a trust for the benefit of Mr. Lamont’s wife was filed on December 16, 2011.2014.

15

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

Named Executive Officers

The Company’s “named executive officers” for 20112014 and their positions with the Company at the end of 2014 were Joseph H. Pyne, Chairman of the Board, David W. Grzebinski, President and Chief Executive Officer, David W. Grzebinski,C. Andrew Smith, Executive Vice President and Chief Financial Officer, and the three other most highly compensated executive officers for 2011,2014, consisting of Gregory R. Binion, President and Chief Operating Officer, William G. Ivey, President-Marine Transportation Group and President of the Company’s principal inland marine transportation subsidiary, James F. Farley, President of the Company’s principal offshore marine transportation subsidiary, and Dorman L. Strahan, President of oneGregory R. Binion, former President-Marine Transportation Group who resigned as an officer of the Company’s two principal diesel engine services subsidiaries. Company effective February 15, 2014. Mr. Pyne served as Chief Executive Officer until April 29, 2014, when he was succeeded by Mr. Grzebinski. Mr. Grzebinski served as Chief Financial Officer until February 25, 2014, when he was succeeded by Mr. Smith.

14

Compensation of the named executive officers is basedprovided primarily onby three compensation elements: (1) base salary, (2) annual incentive compensation and (3) long-term incentives, including stock options, restricted stock and performance awards. The overall goal of the Company’s compensation program is to pay compensation competitive with similar corporations and to tie annual incentives and long-term incentives to corporate performance and a return to the Company’s stockholders.

Compensation Objectives

The objectives of the compensation program are:

to attract and retain senior executives with competitive compensation opportunities;

to achieve consistent performance over time; and

to achieve performance that results in increased profitability and stockholder value.

The Company’s executive compensation program is designed to reward:

performance that contributes to the long-term growth and stability of the Company and the effectiveness of management in carrying out strategic objectives identified for the Company (through the base salary);

the financial and operational success of the Company for the current year (through the annual incentive plan); and

the future growth and profitability of the Company (through long-term incentive compensation awards).

Chief Executive Officer Compensation for 2011

Mr. Pyne’s salary increased from $680,000 to $710,000 in 2011 (an increase of 4.4% over 2010). He earned cash incentive compensation payments of $2,817,297 (an increase of 15.2% over 2010) and received equity compensation awards with a grant date fair value of $1,699,392 (a decrease of .1% from 2010). A total of 62% of his direct compensation (annual bonus, three-year performance award and stock options) was performance-based.

Highlights of Company Performance in 2011

The Company achieved recordstrong financial results in 2011.2014. The following table summarizes a number of key financial measures for 20102013 and 20112014 (dollars in millions except per share amounts):

| 2010 | 2011 | Increase | 2013 | 2014 | Increase | |||||||||||||||||||

Total assets | $ | 1,795 | $ | 2,960 | 65 | % | $ | 3,683 | $ | 4,142 | 12 | % | ||||||||||||

Total revenues | 1,110 | 1,850 | 67 | % | $ | 2,242 | $ | 2,566 | 14 | % | ||||||||||||||

Net earnings attributable to Kirby | 116 | 183 | 58 | % | $ | 253 | $ | 282 | 11 | % | ||||||||||||||

EBITDA(1) | 295 | 436 | 48 | % | $ | 598 | $ | 643 | 8 | % | ||||||||||||||

Earnings per share (diluted)(1) | 2.15 | 3.33 | 55 | % | $ | 4.44 | $ | 4.93 | 11 | % | ||||||||||||||

Return on total capital(1) | 15.3 | % | 17.2 | % | 12 | % | 15.4 | % | 16.6 | % | 8 | % | ||||||||||||

| (1) | Performance measures for annual and long-term incentive compensation discussed under “Elements of Compensation — Annual Incentive Compensation” below. |

16

The Company’s total stockholder return was 49%a negative 19% for the last year and 141%a positive 23% for the last three years. During 2011,

Chief Executive Officer Compensation and Transition

Mr. Pyne’s salary remained at $840,000 while he served as Chairman of the Company expanded its marine transportationBoard and diesel engine businesses into new markets complementaryChief Executive Officer, the same as in 2013, and was reduced to its existing businesses through significant acquisitions.$650,000 when he relinquished the position of Chief Executive Officer effective April 29, 2014. He earned cash incentive compensation payments of $1,984,035 (a decrease of 26% from 2013) and received equity compensation awards with a grant date fair value of $1,500,420 (a decrease of 30% from 2013). A total of 58% of his direct compensation (annual bonus, three-year performance award and stock options) was performance-based.

Mr. Grzebinski’s salary increased from $450,000 in 2013, when he served as Executive Vice President and Chief Financial Officer, to $500,000 (an 11% increase) on January 1, 2014, when he became President and Chief Operating Officer, and then to $700,000 (a 40% increase) in April 2014, when he became President and Chief

15

Executive Officer. He earned cash incentive compensation payments of $959,839 (an increase of 32% from 2013) and received equity compensation awards with a grant date fair value of $1,265,028 (an increase of 107% over 2013). A total of 48% of his direct compensation (annual bonus, three-year performance award and stock options) was performance-based.

Compensation Committee

The Compensation Committee (the “Committee”) of the Board of Directors of the Company has the authority and responsibility to (1) determine the salaries for executive officers of the Company, (2) administer the Company’s annual incentive compensation program, (3) administer all of the Company’s stock option and incentive compensation plans and grant stock options, restricted stock and other awards under the plans (except those plans under which grants are automatic) and (4) review and make recommendations to the Board of Directors with respect to incentive and equity-based compensation plans and any other forms of compensation for executive officers of the Company. The Compensation Committee is composed of four members, all of whom are “independent directors,” “Non-Employee Directors” and “outside directors” as those terms are defined in relevant NYSE standards and federal securities and tax regulations.

The Committee does not delegate any of its authority to determine executive compensation. The Committee considers recommendations from the Chief Executive Officer in making its compensation decisions for executive officers other than the Chief Executive Officer. The Committee will usually but not always, follow those recommendations inwhen setting compensation for other executive officers since the Chief Executive Officer is in the best position to evaluate the contributions of the other executive officers to the success of the Company. The Committee undertakes an independent evaluation of the individual performance of the Chief Executive Officer prior to setting his compensation. The Committee also engaged a compensation consultant in connection with its compensation decisions for 2011.2014.

In determining the compensation of the named executive officers, the Compensation Committee considered all elements of total compensation, including salary, annual incentive compensation, equity-based and other long-term incentive compensation and projected payouts under the Company’s retirement plans. The Compensation Committee also relied in part on the marketplace analysis prepared by Cogent Compensation Partners,Frederic W. Cook & Co., Inc., a compensation consulting firm retained by the Compensation Committee (the “Consultant”), to determine that the Committee’s compensation decisions, both as to specific elements of compensation and as to aggregate compensation, were in a reasonable range for comparable companies and for the positions held by the named executive officers. The Committee also considered the Consultant’s analysis in determining whetherevaluating internal pay equity among the compensation awarded to each named executive officer bears a reasonable relationship to the compensation awarded to the other named executive officers. From that foundation, the Committee refined the individual compensation decisions based on a number of factors, including such factors as the prior year’s compensation, the performance of the Company or its business groups, individual performance of the named executive officer, any increased responsibilities assigned to a particular executive officer, the recommendations of the Chief Executive Officer (except as to his own compensation) and considerations of internal pay equity. However, the final decisions of the Committee are to some extent subjective and do not result from a formulaic application of any of those factors.

Say on Pay

At the Company’s 20112014 Annual Meeting, stockholders approved the compensation of the Company’s named executive officers by 97%98% of the votes cast. Although the Company interpreted the vote as an endorsement of its executive compensation policies and practices, and did not make any significant changes in 2011, the Compensation Committee continues to reevaluate the principal elements of the Company’s executive compensation focusing primarily on the annual incentive plan in 2011 as discussed under “Compensation Consultant” below.an ongoing basis, although no material changes were made for 2014.

17

Compensation Consultant

For 2011,2014, the Compensation Committee engaged the Consultant to provide information for the Committee to consider in making compensation decisions. The Consultant was engaged directly by the Compensation Committee to:

develop areview the reference group of comparable companies used for comparisons of Company performance and executive compensation;

16

perform a marketplace analysis of direct compensation for senior executive officers compared to the reference group of companies and published compensation surveys;

update the Committee on current trends in executive compensation;

consult with the Committee concerning a risk analysisrisks of the Company’s compensation policies and practices;

perform an analysisconsult with the Committee concerning the evaluation of the correlation betweenexecutive compensation by proxy advisory firms;

analyze compensation considerations relating to the Company’s succession plan for the positions of Chief Executive Officer and Chief Financial Officer;

consult with the Committee with respect to the SEC’s executive compensation rulemaking pursuant to the Dodd-Frank Wall Street Reform and its performance;Consumer Protection Act; and

advise on compensation issues related to significant acquisitions by the Company.

In addition, during 2011, the Committee engaged the Consultant to review the Company’s annual incentive plan to determine whether it is consistent with market practices and Company objectives and also to evaluate possible alternative typesdirector compensation program.

At the Committee’s request, the Consultant has addressed the six independence factors for compensation committee advisers that are identified in SEC regulations. The Committee concluded that there are no conflicts of incentive compensation plans. The Consultant reviewedinterest that affect the Company’s current annual incentive plan, compared the Company’s financial performance to the reference groupwork of similar companies developed by the Consultant for purposes of comparison and concluded that the Company’s performance had been superior relative to the reference group over the periods tested and that the payouts under the annual incentive plan for the period 2006-2010 were reasonably aligned with the Company’s performance. The Consultant did not recommend and the Compensation Committee did not implement any changes to the design of the Company’s annual incentive plan during 2011 for the following reasons:

The plan is consistent with industry standards for comparable companies.

The Company’s budgeting process, which is the basis for the plan, is thorough and resulting compensation targets have been realistic.

The alternatives considered by the Compensation Committee would not represent improvements.

The current plan uses easily understood performance measures and provides effective incentives.

The Company’s executive compensation has been within the market range.

Committee. The Consultant was not retained by the Company or any of its affiliates (other than the Compensation Committee) to perform any services during 2011.2014.

Elements of Compensation

Reference Group

Compensation information for a reference group of comparable companies used by the Committee in making compensation decisions was provided by the Consultant. See “Benchmarking” below for more detail and a listing of the companies in the reference group.

Salary

The Compensation Committee attempts to set base salaries for the named executive officers at approximately the median for comparable companies. The Committee and management believe that the Company is a leader in the industries in which it operates and that its employees are frequently targeted by its competitors. Therefore, the Committee generally attempts to set compensation at levels to keep pace with inflation and the competitive market to avoid losing valuable employees.

Based on information available in January 2011,2014, the Consultant determined that the Company’s salaries for its topnamed executive officers averaged approximately 91%97% of the median for the reference group. In setting the

18